The Invisible Cost of Slow AP Processes

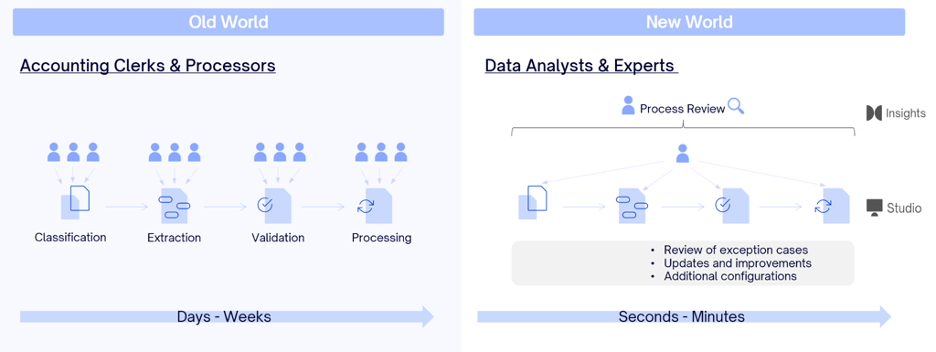

In high-volume distribution industries—whether you’re managing a vast beverage network, a consumer goods supply chain, or a complex multi-location operation—accounts payable (AP) is often the silent profit killer. Many organizations don’t realize the true cost of their outdated, manual-heavy AP systems until inefficiencies start piling up: weekly system outages, skyrocketing personnel costs, lost discounts, and backlogged payments that disrupt operations. Peer group companies that successfully automated this process achieve to transform their AP department from a cost to a profit center, with considerable contributions to growth and profitability.

But why do so many companies struggle with this new reality?

Despite claims of being “automated” or even “autonomous”, most AP systems still rely on outdated OCR tech, and rules-based automation under the label of “intelligent automation”, leaving teams buried in manual work: PO matching, approval routing, tax compliance checks, and coding invoices correctly. The result? Slow cycle times, expensive errors, and missed financial opportunities.

With AI-powered AP automation, these issues disappear. But first, let’s break down exactly where these inefficiencies are killing margins—and why sticking with legacy systems is no longer an option.

The Big Bottlenecks in High-Volume AP Processing

1. Weekly Downtime Disruptions

If you’re dealing with constant system outages from a legacy provider, you already know the consequences:

- P1 downtimes stall invoice processing, creating massive backlogs that push finance teams to work overtime (weekends included).

- Late payments trigger penalty fees and vendor relationship strain.

- The inability to process invoices during outages kills cash flow visibility and decision-making.

2. Manual Processing That Slows Everything Down

Even when the system is running, AP teams are still stuck handling invoices one by one due to outdated OCR-based solutions. Every step—from data capture to approval routing—is a manual process, driving up costs and cycle times:

- Increased labor costs: More staff needed to manage AP processing manually.

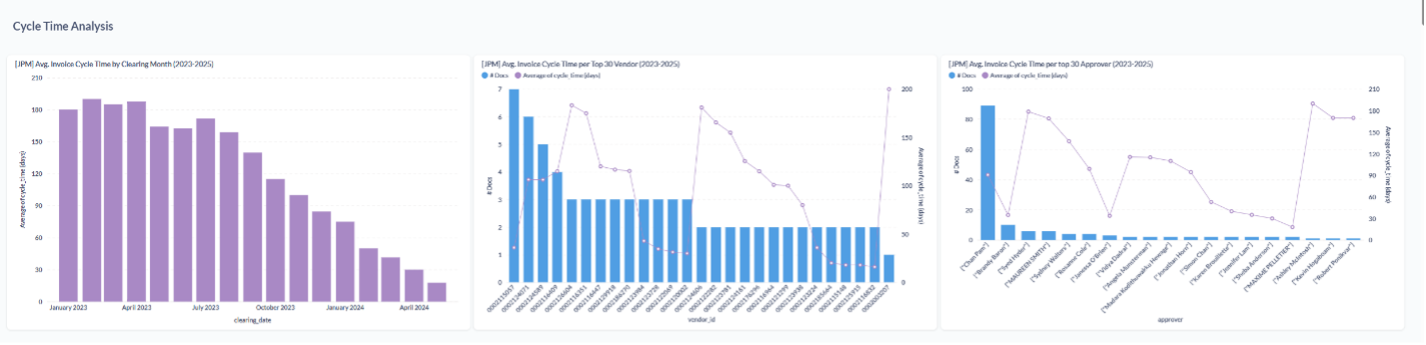

- Longer invoice cycle times: Slower approvals mean missed early-payment discounts and disrupted financial planning.

- Error-prone workflows: Manual data entry and mismatched POs lead to compliance risks, payment delays, and vendor disputes.

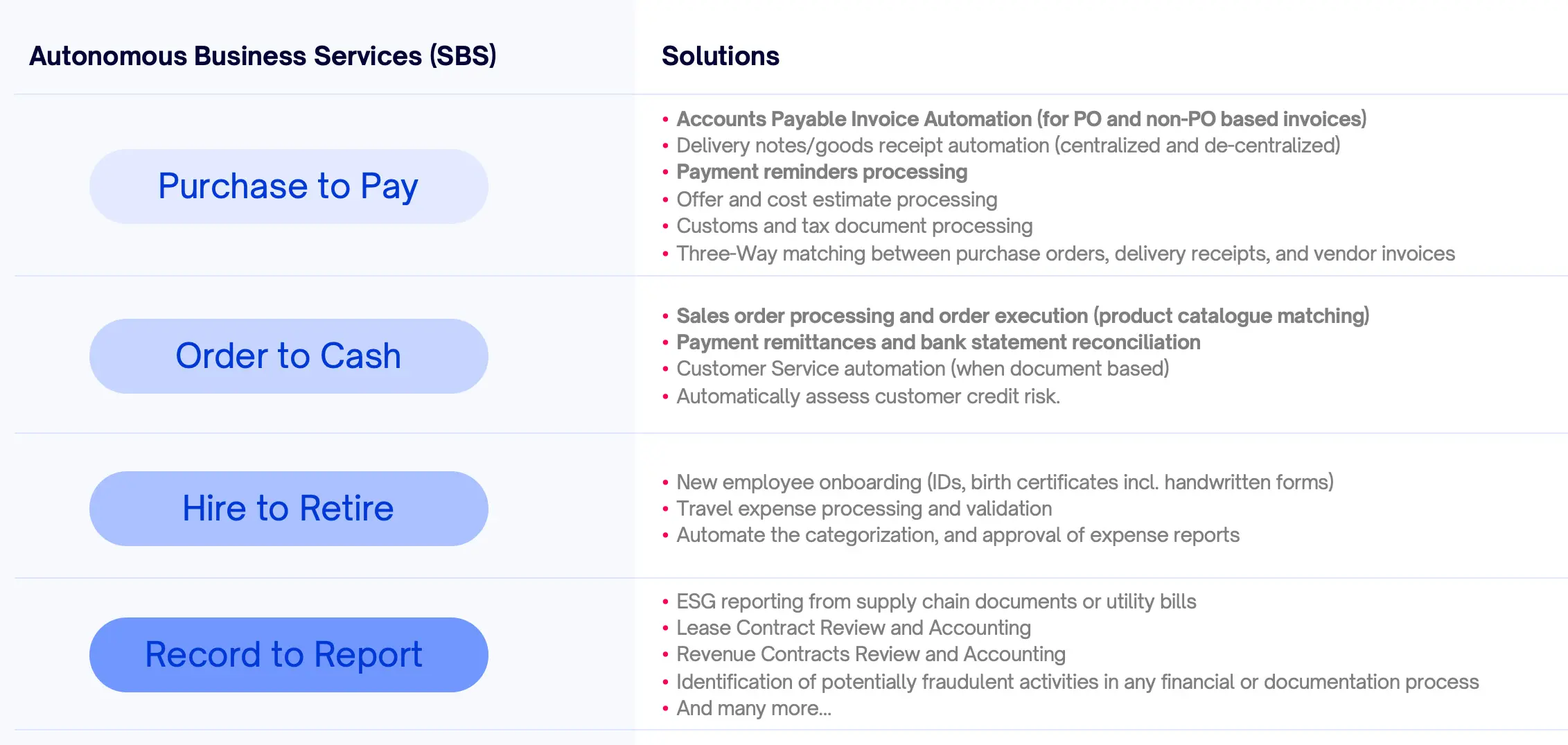

3. Lack of Scalability Beyond AP

Today’s finance leaders don’t just want to automate AP; they want a solution that scales across the business. Legacy AP solutions weren’t built for broader document automation, meaning companies face limitations in:

- Sales order processing

- Tax compliance validation

- GL coding automation

- Automated PO matching for complex purchase orders

4. AI Hesitation: Is a Startup the Right Choice?

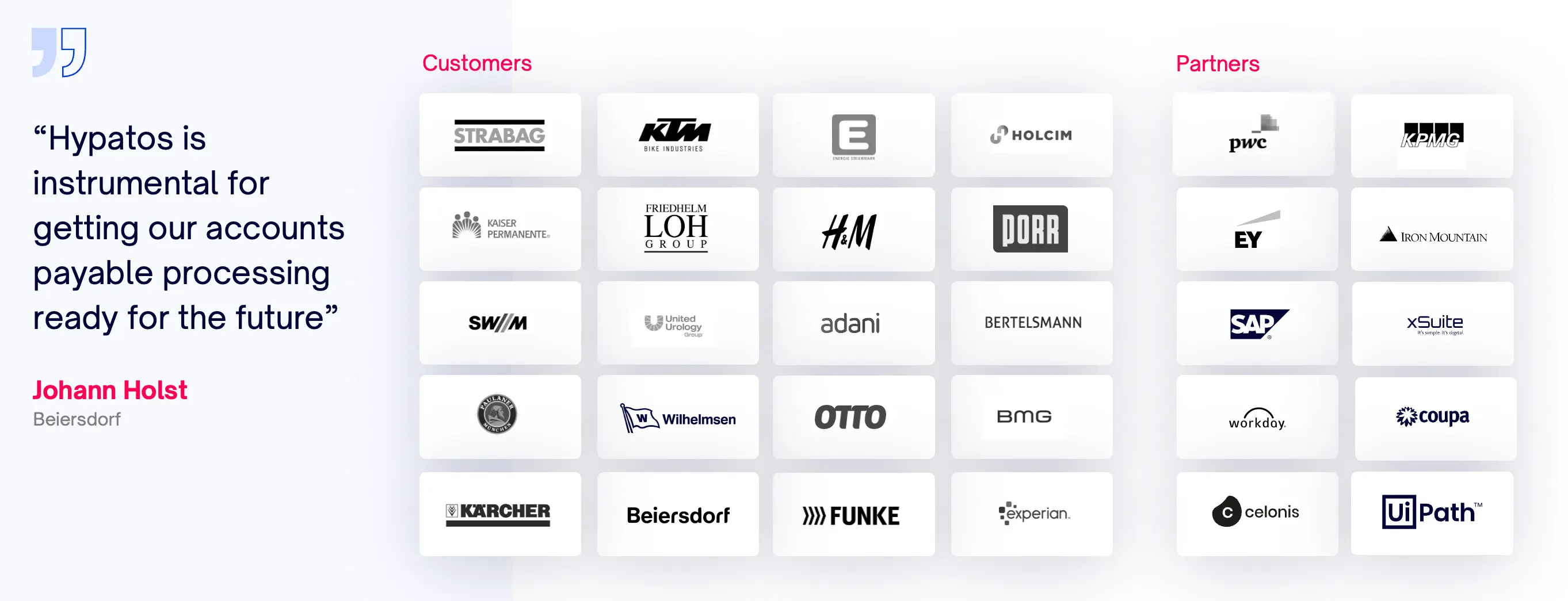

For companies considering a next-gen AI-powered platform, there’s often hesitation about working with a provider outside of the U.S. The truth? This isn’t untested tech.

- Hypatos has over 50+ enterprise clients successfully running AI-powered AP automation.

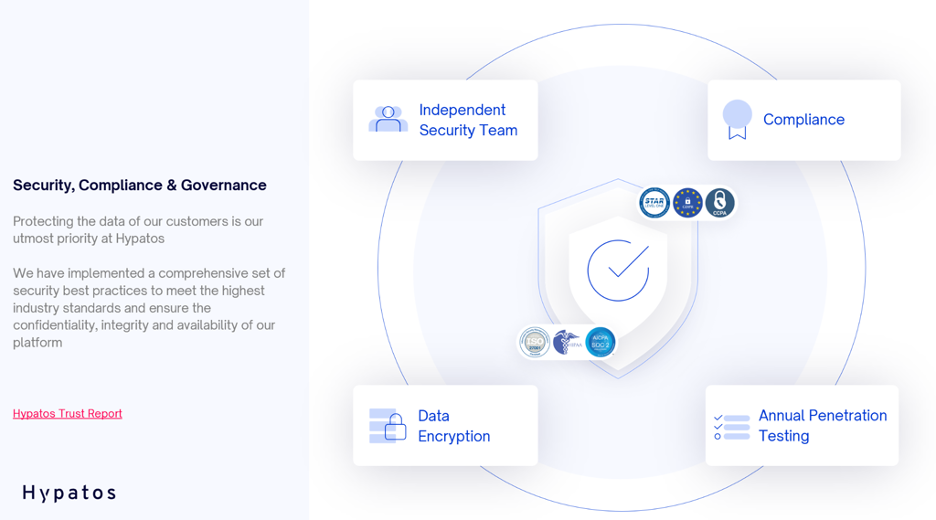

- 24/7 support, enterprise-grade SLAs, and full security certifications (SOC 2, ISO 27001, GDPR compliant).

- Big Four validation: Hypatos partners with top consulting firms worldwide, ensuring best-in-class implementation and process alignment.

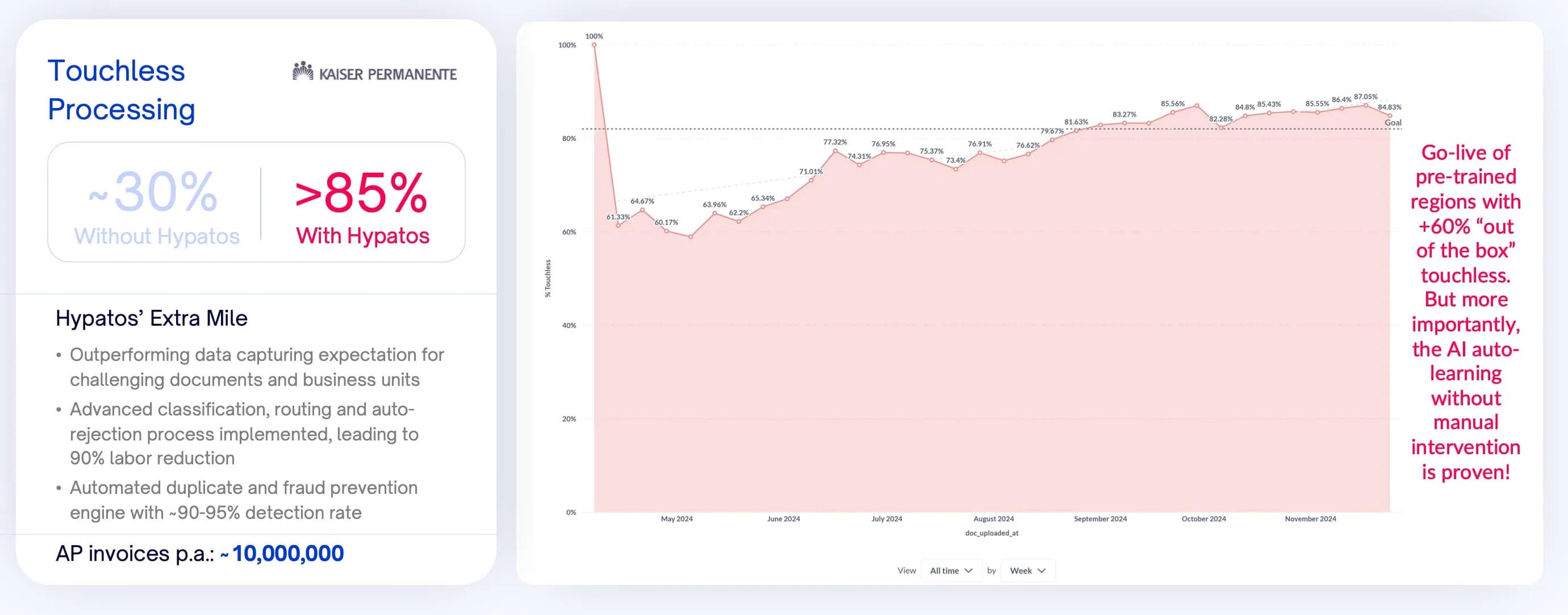

- Proven results: With key clients like H&M and Kaiser Permanente, AI-driven AP automation has already proven to be a game-changer.

- Constant load tests with simulated loads of more than 75 million documents per month throughput (and technically infinite throughput capabilities due to dynamic scaling in Hypatos cloud and any private cloud environments)

The AI-Driven AP Solution: What Modern Finance Teams Gain

Next-gen AI-powered AP automation isn’t just about digitizing invoices—it’s about making AP truly autonomous. Here’s what that looks like in practice:

✅ 99.999% Uptime & Zero Downtime Interruptions

Modern AI-powered AP platforms are cloud-based, offering highly stable, dynamically scalable infrastructure. This eliminates the risk of weekly system failures that disrupt operations.

✅ 90%+ Reduction in Manual AP Work

AI Agents take over data entry, validation, PO matching, and compliance checks. Finance teams no longer waste time on repetitive tasks, allowing them to focus on strategy, cash flow planning, and vendor negotiations.

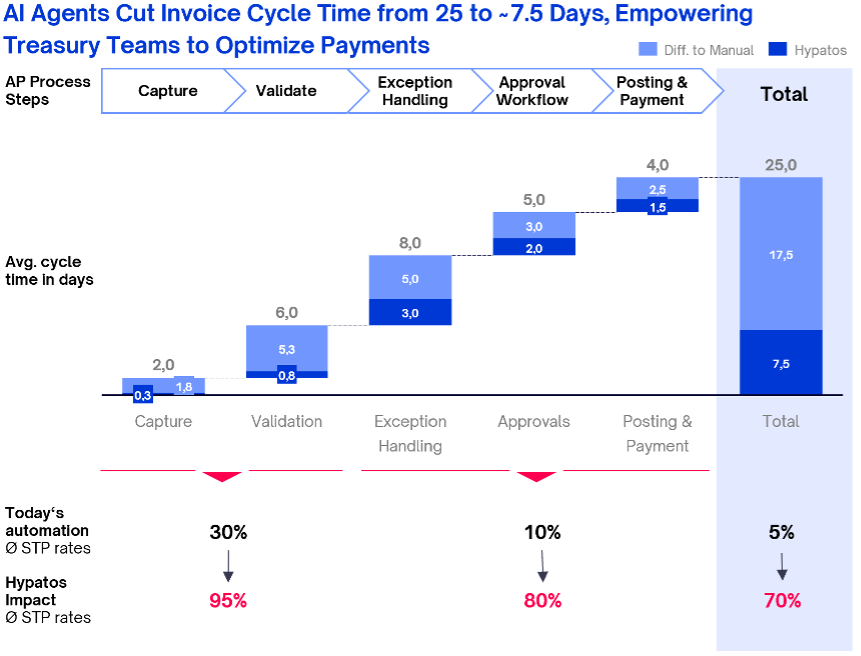

✅ Faster Invoice Cycle Times = Better Cash Flow

By automating approval routing and eliminating bottlenecks, companies cut invoice processing time by 70%, improving cash flow and allowing finance leaders to leverage early-payment discounts more effectively.

✅ Fewer Errors, Lower Compliance Risk

AI-powered validation ensures that invoices meet tax, regulatory, and internal compliance standards before posting—reducing the risk of penalties and vendor disputes.

✅ A Scalable Foundation for Document Processing

Unlike legacy solutions that only automate invoice processing, modern AI-powered platforms extend automation to other finance functions: sales orders, tax validation, GL coding, and beyond.

Final Thought: The Real Risk is Doing Nothing

The reality is this: sticking with an outdated, unstable AP system is costing more than you think.

Every week of downtime, every delayed invoice, every missed discount is money left on the table. AI-powered AP automation isn’t just a tech upgrade—it’s a profitability unlock.

So, the real question is: how much longer can your finance team afford to wait?

.png)